Attention: Briefing On Economic Operation Of China'S Clothing Industry From January To November 2022

Since 2022, the overall economic operation of China's clothing industry has continued to slow down. Especially in November, the international environment has become more severe and complex, the global economy has continued to weaken, the impact of the rebound of the domestic epidemic has increased, the shrinking trend of domestic and foreign market demand has become more obvious, the economic operation of the industry has been greatly impacted, and the decline of production, domestic sales, and efficiency indicators has expanded, The downward pressure on the outlet is prominent. In the face of new changes and new challenges, garment industry enterprises need to firmly believe in and take the lead, continue to deepen transformation and upgrading, adhere to innovation driven coordinated development, focus on preventing and resolving major and systematic risks, constantly enhance the safety, controllability and competitiveness of the industrial chain supply chain, and strive to promote the stable recovery and high-quality development of the industry.

01 Economic operation of clothing industry

Apparel production has dropped significantly

Since 2022, due to adverse factors such as the rebound of the domestic epidemic, sluggish market demand and declining export volume, the production growth of China's clothing industry has continued to slow down, and the decline of industrial added value and clothing output of enterprises above designated size has gradually deepened. According to the data of the National Bureau of Statistics, from January to November, the industrial added value of enterprises above designated size in the clothing industry decreased by 0.9% year on year, 9.8 percentage points slower than that of the same period in 2021. Since July, the decline of industrial added value of enterprises above designated size in the clothing industry has continued to deepen, reaching 10% and 12.4% in October and November. In the same period, the clothing output of enterprises above designated size reached 21.16 billion pieces, a year-on-year decrease of 3.42%, 1.94 percentage points higher than that in the first half of the year, and 11.95 percentage points lower than that in the same period of 2021. Among them, the output of woven clothing was 7.957 billion pieces, down 5.40% year on year, and the output of knitted clothing was 13.203 billion pieces, down 2.19% year on year, with the growth rate down 8.58 and 14.56 percentage points respectively compared with the same period in 2021.

Figure 1 Production Growth of Clothing Industry from January to November 2022

Data source: National Bureau of Statistics

The domestic market continues to be under pressure

Influenced by factors such as the spread of the domestic epidemic in many places and the weakening of demand, the domestic clothing market in China has declined significantly. In May, the retail sales of clothing commodities above the designated size fell by 10.1%. Since June, thanks to the efficient coordination of epidemic prevention and control and economic and social development by governments at all levels, as well as the remarkable effectiveness of consumption promotion policies, the domestic sales of clothing have shown a trend of improvement and recovery, and the decline has narrowed for four consecutive months. In October and November, as the epidemic rebounded in a large area, residents went out shopping and socialized less, and the domestic clothing market was hit again. According to the data of the National Bureau of Statistics, from January to November, the retail sales of clothing goods of units above designated size in China totaled 829.46 billion yuan, down 6.9% year on year, 1.1 percentage points lower than the first half of the year, and 23.3 percentage points lower than the same period in 2021; In November, the retail sales of clothing commodities above the designated size fell 17.1% year on year. Physical sales dropped significantly. According to the statistics of China National Business Information Center, from January to November, clothing retail sales and retail sales of major retail enterprises in China dropped 12.3% and 16.2% respectively year on year, and clothing retail sales and retail sales in November fell 29.0% and 26.0% respectively year on year. The growth rate of online clothing retail slowed down significantly. From January to November, the online retail sales of clothing products increased by 3.4% year on year, 1.0 percentage points faster than the first half of the year, and 7.7 percentage points slower than the same period in 2021.

Figure 2 Clothing sales in the domestic market from January to November 2022

Data source: National Bureau of Statistics

Exports maintain a small growth

From the perspective of the whole year, since 2022, China's clothing export scale has continued to maintain a small growth on the basis of last year's high base, setting a new record of clothing export scale in the same period since 2016. However, from the perspective of monthly exports, the growth rate of clothing exports showed a trend of high in the first place and low in the second. In the first seven months, driven by factors such as the continued recovery of international market demand, rising costs driving price increases, clothing exports have maintained a rapid growth. However, since August, due to the increased risk of global economic recession, inflation in many developed economies has remained high, leading to weakening consumer demand in the international market, Superimposed by multiple factors such as the recovery of overseas supply chain and Sino US trade frictions, the growth of clothing exports slowed down significantly. In September, clothing exports turned negative, and in October and November, exports fell by 16.8% and 14.4%. According to Chinese customs data, from January to November, China's clothing and clothing accessories exports totaled US $160.527 billion, up 4.2% year on year, 7.8 percentage points slower than the first half of the year; The volume of clothing exports fell and the price rose. The number of clothing exports was 28.67 billion, down 1.6% year on year. The average unit price of clothing exports was 4.63 US dollars/piece, up 10.2% year on year. Among them, the export value of knitted clothing and clothing accessories was 83.442 billion US dollars, up 6.84% year on year, the export volume decreased 1.1% year on year, and the export unit price increased 7.3% year on year; The export value of woven clothing and clothing accessories was 70.154 billion US dollars, up 10.94% year on year, the export volume decreased 2.8% year on year, and the export unit price increased 14.3% year on year.

Figure 3 Exports of China's clothing and clothing accessories from January to November 2022

Data source: China Customs

The export of cotton clothing turned to negative growth, and the quantity and price of commuting and cold proof clothing with high added value rose simultaneously. According to Chinese customs data, from January to November, China's cotton clothing exports fell 0.2% year on year. Since August, China's cotton clothing exports have continued to decline. In October and November, China's cotton clothing exports fell 26.2% and 24% year on year respectively; Among them, the export of cotton clothing to the United States dropped 4.3% year on year, and in November, China's export of cotton clothing to the United States dropped 32.4% year on year. From the perspective of export categories, the export volume of overcoats, suits, casual suits and skirts increased by 17.9%, 35.4%, 23.2% and 7.1% year on year respectively, the export unit price increased by 6.2%, 20.8%, 4.3% and 2.9% year on year respectively, the export volume of shirts increased by 29% year on year, and the export unit price increased by 0.4% year on year; The export volume of down jacket, trousers and underwear household clothing fell and the price rose. The export volume fell by 10.5%, 4.7% and 2.5% respectively year on year, and the export unit price increased by 14.3%, 9.7% and 2.9% respectively year on year. In addition, the export volume of ski, swimming and other sportswear rose and fell, with the export volume increasing by 19.7% year on year and the export unit price declining by 0.6% year on year.

The proportion of China's clothing exports to traditional markets has declined, and its exports to emerging markets such as ASEAN, countries and regions along the Belt and Road have maintained rapid growth. According to Chinese customs data, from January to November, China's clothing exports to the three traditional markets of the United States, the European Union and Japan totaled US $80.26 billion, up 1.8% year on year, accounting for 50% of China's total clothing exports, 1.2 percentage points less than the same period in 2021, and driving the growth of clothing exports by 0.9 percentage points. Among them, China's clothing exports to the United States amounted to 35.6 billion US dollars, down 1.3% year on year. In October and November, China's clothing exports to the United States declined 35.6% and 19.4% year on year respectively; China's clothing exports to the EU reached US $31.07 billion, up 6.5% year on year. In October and November, China's clothing exports to the EU fell 33.1% and 18.7% year on year respectively; China's clothing exports to Japan amounted to US $13.59 billion, unchanged from the same period in 2021, with an increase rate of 6.3 percentage points slower than that in 2021. In the same period, ASEAN overtook Japan to become the third largest trade partner of China's clothing exports, with clothing exports worth 14.83 billion US dollars, up 23.8% year on year; China's clothing exports to countries and regions along the Belt and Road and Latin America continued to maintain rapid growth, with growth rates of 13.4% and 20.1% respectively; China's clothing exports to other RECP member countries reached US $12.12 billion, up 8.4% year on year. In addition, China's clothing exports to the UK fell 10.1% year on year, while those to Russia and Canada fell 18.7% and 15.9% year on year respectively.

The eastern region is still the main concentration of China's clothing exports, while the clothing exports in the central and western regions have grown rapidly. According to Chinese customs data, from January to November, China's top five garment export provinces, Zhejiang, Guangdong, Jiangsu, Shandong and Fujian, completed a total of $113.6 billion in garment exports, up 1.5% year on year, accounting for 70.8% of China's total garment exports, 1.9 percentage points lower than the same period in 2021. Among them, Zhejiang has become the largest garment export province in China, with an export value of 32.49 billion US dollars, up 15.6% year on year; The clothing exports of Jiangsu Province and Shandong Province increased by 0.5% and 5.4% year on year respectively; The clothing exports of Guangdong and Fujian decreased by 7.6% and 9.3% respectively year on year, accounting for 2.1 and 1.4 percentage points respectively in the national clothing exports. Over the same period, the total amount of clothing exports in central and western China increased by 25.7% year on year, accounting for 18.8% of the total national clothing exports, 3.2 percentage points higher than the same period in 2021. Among them, Xinjiang's clothing export maintained a rapid growth, with a growth rate of 74.9%, overtaking Shanghai as the sixth largest province in China's clothing export; The clothing exports of Jiangxi, Hunan, Liaoning and Sichuan increased by 25.1%, 40.5%, 14.2% and 20.3% year on year respectively, while the clothing exports of Anhui, Hebei and Hubei decreased by 6.0%, 41.2% and 10.1% year on year respectively.

The decline of enterprise benefits deepened

In November, affected by the rebound of the domestic epidemic in a large area, the production and marketing cycle of the clothing industry was limited, the pressure on business operations increased, the cumulative decline in operating income and total profits deepened, and the economic operation of the industry was under serious pressure. According to the data of the National Bureau of Statistics, from January to November, there were 13224 enterprises above the designated size (annual main business income of 20 million yuan and above) in the clothing industry of China, achieving an operating income of 1307.69 billion yuan, a year-on-year decrease of 3.3%, a decline of 7.8 percentage points over the first half of the year, and a decline of 11 percentage points over the same period in 2021; The total profit was 65.76 billion yuan, down 7.4% year on year. The growth rate was 11.4 percentage points lower than that of the first half of the year, and 20 percentage points lower than that of the same period in 2021. The expansion of industry losses, the slowdown of operating efficiency, and the high cost make it difficult to improve corporate profits. From January to November, the loss of enterprises above designated size in the clothing industry reached 20.45%, 1.43 percentage points higher than the same period in 2021, and the loss of loss making enterprises increased 7.4% year on year; The operating income per 100 yuan includes 85.7 yuan of cost, an increase of 0.5 yuan over the same period in 2021; The operating income profit margin was 5.03%, down 0.23 percentage points from the same period in 2021; The turnover rate of finished products, accounts receivable and total assets were 12.1 times/year, 7.5 times/year and 1.3 times/year, respectively, down 5.8%, 3.7% and 2.1% year on year; The asset liability ratio was 52.1%, 0.15 percentage points higher than the same period in 2021.

Figure 4 Main benefit indicators of clothing industry from January to November 2022

Data source: National Bureau of Statistics

Investment maintained rapid growth

Since 2022, fixed asset investment in China's clothing industry has maintained a rapid growth trend, but the growth rate has slowed down. According to the data of the National Bureau of Statistics, from January to November, the completed investment in fixed assets in China's clothing industry increased by 28.1% year on year, 5.7 percentage points slower than the first half of the year, 26.6 percentage points higher than the same period in 2021, and 22.7 and 18.8 percentage points higher than the overall level of the textile and manufacturing industries.

Figure 5 Growth rate of fixed asset investment in clothing industry from January to November 2022

Data source: National Bureau of Statistics

02 2023 Market Situation Analysis at Home and Abroad

international market

On the one hand, the risk of global economic recession continues to rise, and future uncertainty is weakening global consumption capacity and confidence. OECD predicts that the global economic growth will slow to 2.2% in 2023; IMF lowered the world economic growth forecast to 2.7% in 2023, and predicted that about one-third of the world's economies would shrink; The latest barometer index of global trade in goods released by the WTO is 96.2, a contraction trend below the critical point, indicating weak demand for commodity trade and insufficient growth momentum. Influenced by economic recession, high inflation and other factors, consumer confidence in the United States, the European Union and other major markets declined, and the inventory pressure of clothing retailers continued to rise. In November 2022, except for the growth of clothing retail in some economies such as Singapore and Japan, clothing retail in major global markets will continue to be weak. On the other hand, the supply chain of the global industrial chain has been deeply adjusted, and global competition has intensified. Against the backdrop of the depreciation of major currencies against the US dollar and the continuous rise of production factor costs, many garment enterprises and brands have accelerated their investment in Southeast Asian countries and increased the proportion of OEM in Southeast Asia to cope with high inflation and supply chain security risks. At the same time, the trend of procurement diversification of multinational garment enterprises is more obvious. Although China is still the main source of purchase for clothing enterprises in Europe and the United States, the purchase volume in Southeast Asia and South Asia countries such as Vietnam, Bangladesh, India continues to increase, which will further increase the downward pressure on China's clothing exports.

domestic market

Despite the severe and complex international environment and the triple pressures of shrinking domestic market demand, supply shock and weakening expectations, the operating pressure of China's clothing enterprises continues to rise, and the economic operation of the clothing industry is under serious pressure. However, with the implementation of various national policies to expand domestic demand and promote consumption step by step, consumer demand will continue to release, and the domestic market will gradually recover. On December 14, 2022, the Central Committee of the Communist Party of China and the State Council issued the Outline of the Strategic Plan for Expanding Domestic Demand (2022-2035), and then the National Development and Reform Commission issued the Implementation Plan of the "Fourteenth Five Year Plan" Strategy for Expanding Domestic Demand. The two documents put forward specific measures around comprehensively promoting consumption, accelerating consumption quality upgrading, etc., in order to accelerate the return of economic development to the normal track Achieving a holistic turnaround provides an important starting point. At the same time, in the face of multiple pressures and challenges, clothing enterprises have increased their diversification efforts, constantly innovated business models, expanded marketing channels, and improved marketing and profitability through social marketing, live video, online shopping and other ways. With the orderly opening of the national epidemic prevention and control policy, and superimposed on the traditional consumption peak season of the Spring Festival, all major clothing brands have launched various promotional activities, which will further accelerate the recovery of the clothing consumption market.

Facing the complex and severe development situation at home and abroad, garment enterprises should strengthen their confidence, make progress while maintaining stability, continue to enhance their innovation ability, accelerate transformation and upgrading, optimize product structure, and enhance their market competitiveness. At the same time, it is necessary to seize the development opportunities brought by RCEP, increase the development of markets along the "Belt and Road" such as ASEAN, and respond to the challenges of uncertainty through global layout.

(Source: China Garment Association)

- Related reading

Industrial Producers' Ex Factory Prices In December 2022 Fell 0.7% Year On Year And 0.5% Month On Month

|

Brief Introduction To The Economic Operation Of The Silk Industry In The First Three Quarters Of Last Year

|

The Export Volume Of China'S Wool Fabrics Will Increase By 50% Year-On-Year From January To November 2022

|

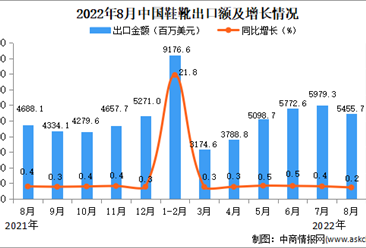

Industry Data: Statistical Analysis Of China'S Shoes And Boots Export Data In August

|- Industry stock market | Securities News: Hongdou Shares Plans To Raise Funds To Upgrade Men'S Clothing Business In A Multi-Dimensional Layout

- Footwear industry dynamics | How To Break Through The New Year'S Marketing War? Kenopo'S Creativity Won The Favor Of The Mother Circle

- Local hotspot | Local Hot Spot: Guangnan County, Wenshan Prefecture National Costumes Popular New Year Goods Market

- Standard quality | Industry Standard: Textile And Clothing Related Group Standards Were Selected Into The 2022 Group Standard Application Demonstration Project Of The Ministry Of Industry And Information Technology

- Listed company | Golden Eagle (600232): The Cancellation Of Wholly-Owned Subsidiary Has Been Completed

- Listed company | Jiangsu Sunshine (600220): Yu Qinfen, The Person Acting In Concert With The Controlling Shareholder, Has Not Yet Increased His Shareholding In The Company'S Shares

- I want to break the news. | BEAMS X Levi'S Co Branded Black Tannins Ready To Design

- Information Release of Exhibition | Focus On Industry Exhibitions: Restore Industry Confidence, And CHIC Will Start Again With Full Packaging

- Popular this season | Fashion Trend: Appreciation And Reference Of Spring And Autumn Series

- Recommended topics | Sima'S Flagship Store On Chunxi Road, Chengdu, Makes A New Appearance, Playing With Youth

- Securities News: Hongdou Shares Plans To Raise Funds To Upgrade Men'S Clothing Business In A Multi-Dimensional Layout

- How To Break Through The New Year'S Marketing War? Kenopo'S Creativity Won The Favor Of The Mother Circle

- Local Hot Spot: Guangnan County, Wenshan Prefecture National Costumes Popular New Year Goods Market

- Industry Standard: Textile And Clothing Related Group Standards Were Selected Into The 2022 Group Standard Application Demonstration Project Of The Ministry Of Industry And Information Technology

- Golden Eagle (600232): The Cancellation Of Wholly-Owned Subsidiary Has Been Completed

- Jiangsu Sunshine (600220): Yu Qinfen, The Person Acting In Concert With The Controlling Shareholder, Has Not Yet Increased His Shareholding In The Company'S Shares

- BEAMS X Levi'S Co Branded Black Tannins Ready To Design

- Focus On Industry Exhibitions: Restore Industry Confidence, And CHIC Will Start Again With Full Packaging

- Fashion Trend: Appreciation And Reference Of Spring And Autumn Series

- Sima'S Flagship Store On Chunxi Road, Chengdu, Makes A New Appearance, Playing With Youth